Common Senior Scams: Avoiding scams that often target seniors

Many seniors use computers and smartphones on a routine basis. Unfortunately, seniors are often left vulnerable to Internet fraud as they may not be familiar with common scams that prey on those who are less computer savvy. This article will help you identify two common senior scams and take the necessary steps to protect yourself.

PHONY PHONE CALLS

Some scammers use a technique called “Caller ID spoofing” which makes a telephone call seem like it’s coming from a legitimate company or a known phone number. When you answer the phone, there is often a prerecorded message that asks for personal information and credit card numbers to “verify” your account. In reality, this is an attempt to steal your personal and financial information.

How can you protect yourself?

Be suspicious of any unknown callers and don’t trust caller ID completely. Most companies will not ask for personal information over the phone.

Ask questions: be sure to ask who you are speaking with and verify what company they are working for. Don’t hesitate to trust your instincts; if something seems “off” about the call, end it. A legitimate company will give you a call back number that you can verify on their website.

Never give personal or financial information to a company that calls you. Tell them you’ll verify that they are legitimate and call them back. If they claim to be one of your bank representatives, for example, call the number that is on your bank statement.

National Do Not Call Registry

Although scammers will often ignore federal rules, it is a good idea to register your number with the National Do Not Call registry at donotcall.gov. Any legitimate telemarketer obeys these rules and regulations. If you think you’ve been a victim of telephone fraud you can contact the Internet Crime Complaint Center at www.ic3.gov.

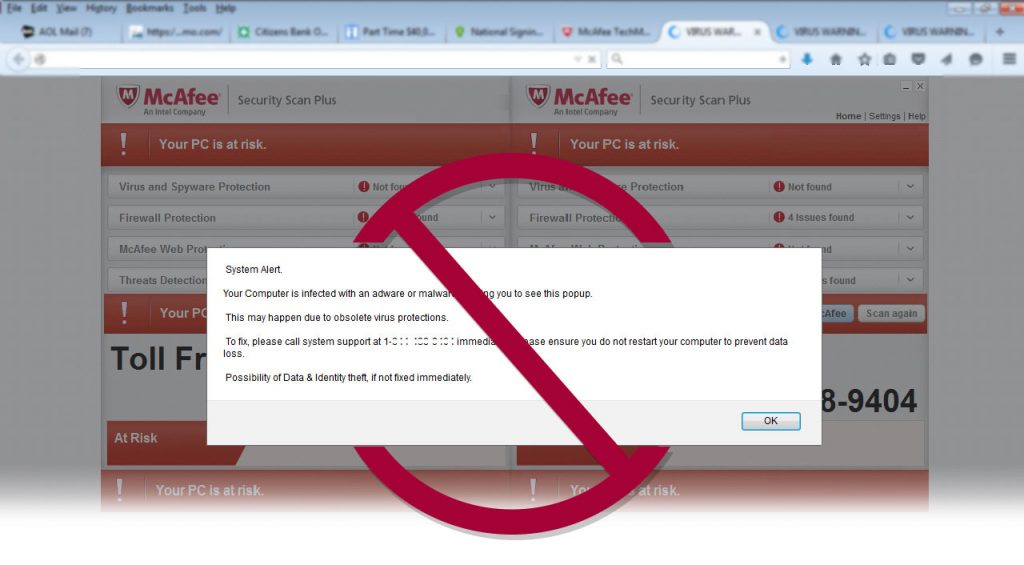

POP-UP BROWSER WINDOWS

Some Internet scams use your computer as a way to prompt you to call them to collect your information. This is sometimes referred to as “scareware” and it can seem very realistic. If you are not careful, programs can be installed on your computer without your knowledge that makes it difficult or impossible to use.

The Federal Trade Commission (FTC) lists many variations of “scareware.” You can look for these telltale signs to identify these kinds of scams:

- ads that promise to scan for viruses, improve your computer’s performance or remove harmful files

- alerts about malicious software or illegal pornography on your computer

- offers to download free software to perform a security scan or improve your computer’s performance

- pop-up ads that claim your security software is out of date or that your computer is in immediate danger

These scammers collect personal information, credit card numbers or may ask for bank account information or passwords to “verify” your account when you purchase these misleading products. These companies will even purchase ad space on popular and trusted websites.

The FTC suggests that you close your web browser if you’re faced with any of the warning signs of a scareware scam or suspect a problem. Don’t click “No” or “Cancel,” or even the “x” at the top right corner of the window. Some scareware is designed so that any of those actions will activate the program. If you use Windows, press Ctrl + Alt + Delete to open your Task Manager, then click “End Task.” If you use a Mac, press Command + Option + Q + Esc to “Force Quit.“

Lastly, make it a practice not to click on any links within pop-ups.

The FBI recommends that you take precautions to ensure your operating system is updated and your legitimate security software is current. If you receive a suspicious pop-up, close the browser or shut down your computer system then run a full anti-virus scan when the computer is turned back on.

If you suspect you’ve been the victim of a scam…

Don’t be afraid or embarrassed to talk about it with someone you trust. You are not alone, and there are people who can help. Doing nothing could potentially make things worse. Keep handy the phone numbers and resources you can turn to, including the local police, your bank (if money has been taken from your accounts), and Adult Protective Services.

To obtain information for Adult Protective Services in your area, call the Eldercare Locator, a government-sponsored national resource line, at 1-800-677-1116, or visit their website at https://eldercare.acl.gov/Public/Index.aspx

SOURCES: AARP Bulletin, National Council For Aging, Paul Davis, “How to Recognize A Fake Virus Warning” Business Know-How.com